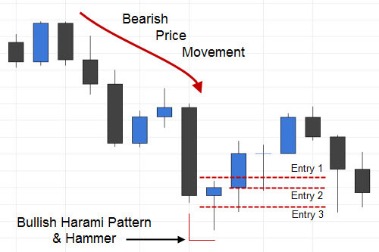

The pattern confirmed when the price breaks above the upper trendline of the wedge, indicates that sellers in the Bitcoin market are losing strength and that buyers are taking over. Since both of these apply to symmetrical triangle patterns, depending on the case, this pattern can show as a bullish or a bearish trend. The original definition of the falling wedge includes a recommendation with regards to volume, and dictates that it’s preferable if it falls as the pattern is forming. As we mentioned earlier, false breakouts is one of the biggest challenges breakout traders face. One common techniques that attempts to make them fewer, is to add some distance to the breakout level itself.

The aforementioned pattern is considered a bullish pattern, which occurs after a bearish price action. During a falling wedge, the asset is seen consolidating right before it breaks off from the upper trend line. CryptoTale is an unbiased news portal providing breaking news, guides, blockchain news, and crypto price analysis & forecasts for bitcoin price and other altcoins. The falling wedge pattern, with its converging support and resistance lines, offers a glimmer of hope for those eagerly awaiting the next bull run.

In the case of the falling wedge, this usually is a small distance below the wedge. The most important aspect is to place the stop at a level where the market is given room to have its random price swings bounce around, without it impacting hitting the stop too often. The concept of false breakouts isn’t only a concern when it comes to entry triggers, but stop losses placed too close could easily be hit for no apparent reason.

Key Market Insights for Traders of Stellar (XLM), Arbitrum…

Market analysts have been paying close attention to the falling wedge pattern, which frequently signals an impending bullish trend. Traders and investors have been keeping a watchful eye on Bitcoin’s price movements, waiting for the anticipated breakout before the pattern’s apex. On the contrary, a bearish symmetrical triangle is an example of a chart pattern that exhibits a continuation of the downtrend. The action preceding the development of the symmetrical triangle has to be bearish for the triangle to be termed bearish. Symmetrical triangle patterns can sometimes also be referred to as wedge chart patterns, depending on the circumstances. There are some things you must remember while trading with the symmetrical triangle pattern in order to prevent any loss or trap.

Bitcoin, Ethereum, XRP Forecast: Key Trading Levels For The Crypto Giants Amid SEC’s Ripple Appeal – FX Empire

Bitcoin, Ethereum, XRP Forecast: Key Trading Levels For The Crypto Giants Amid SEC’s Ripple Appeal.

Posted: Thu, 10 Aug 2023 07:00:00 GMT [source]

This ensures that the breakout level is hit fewer times by accident, which in theory makes those few times it’s actually crosses more reliable. The image below shows an example of the stop loss placement in relation to the falling wedge. As should be falling wedge bitcoin clear, it’s placed slightly below the support level, to give the market enough room for its random swings. ETH dropped below a key support in its USD/BTC pair, but analysts say a bullish trading pattern could eventually spark a sharp trend reversal.

Ethereum Weekly Chart

There have been price rejections to both the upside and downside, which we have highlighted on the chart. Falling wedge patterns are commonly known as reversal patterns; however, there is a lack of bullish momentum here, and the failure to continue above our EMA… The 4H chart shows that the BCH price has been in a strong bearish trend in the past few days. However, a closer look shows that the coin has formed a falling wedge pattern, which is usually a bullish sign. With each successive price increase or wave upwards, volumes continue to decline, showing that market demand is waning at the price that is higher. When a bearish market is established, a rising wedge pattern is comparatively more accurate.

Instead of going long as the market breaks out to the upside, they wait for the market to revisit the breakout level, ensure that it holds, and then decide to enter the trade. This way you reduce the risk of falling victim for as many false breakouts, as you first check if the market really respects the breakout level. As soon as the market has broken out to the upside, many market participants notice that bulls have taken the lead, and choose to take part in what they assume is the start of a bullish price swing. As such, buying pressure increases even more, which helps to ensure the continuation of that positive price swing. In general terms, trends that have been persisting for longer periods of time, will be more robust and harder to break than trends that haven’t been in play for so long.

Does Bitcoin’s Falling Wedge Mean Higher Prices?

On the 4 Hour chart, we can see the two falling wedges that have formed within the same price range as each other. Maxx Momentum indicator also shows similarities as momentum turns red throughout the later stages of the falling wedge towards the breakout. A falling wedge is a technical chart pattern characterized by a contracting price range between two converging trendlines. Typically, these wedges tend to break out before reaching their apex, leading to significant price movements. In this case, Jelle’s analysis suggests that Bitcoin’s current boring consolidation phase could be nearing its end, paving the way for a potential surge in value. When prices make lower highs and lower lows, in comparison to past price moves, this pattern is generated.

Popular Altcoins that are at the Foothill of a Massive Explosion: SUSHI, EOS, CHR, and HBAR – Coinpedia Fintech News

Popular Altcoins that are at the Foothill of a Massive Explosion: SUSHI, EOS, CHR, and HBAR.

Posted: Tue, 15 Aug 2023 07:00:00 GMT [source]

Having said that, here is what a falling wedge might tell us about how market players act at the moment. With the exact definition of the pattern covered, we’ll now look at what might be going on as the pattern forms. Even if it’s impossible to ascertain one type of market structure that applies to every single occurrence of a price pattern, we can learn a lot from trying to understand the psychology behind a move.

Bitcoin’s Drop Below $26k Prompting Massive…

The simplest approach to notice the narrowing of the channel, which is the initial significant clue that a reversal is brewing, is to use trend lines. Most trading patterns and formations cannot be used on their own, since they simply aren’t profitable enough. Still, they can provide a great foundation, on which you may add various filters and conditions to improve the accuracy of the signal provided. In other words, you try to rule out those patterns that don’t work so well. The stock market is a perfect example of this, where the continuous improvements of the economy over time drives the bullish trend. When the wedge starts to form you should be able to draw a line that connects the local highs, and another one that connects the local lows.

The falling wedge pattern appears when the asset’s price is moving in an overall positive trend just before the price movement corrects lower. When the price movement breaks through the resistance of the top trend line or wedge, the consolidation phase is over. EURUSD is currently in a falling wedge and is awaiting a break of the new range zone.

Bitcoin retested the Wedge support, followed by a sharp rebound that broke the pattern’s resistance. The move confirmed the second breakout out of what appeared like a restored Falling Wedge, with its new upside target set near $9,500. Hence, there’s a possibility that this bullish wedge pattern may show weakness as well … Or that we’ll have to wait for volume to return before any bullish moves are made.

- Traders and investors have been keeping a watchful eye on Bitcoin’s price movements, waiting for the anticipated breakout before the pattern’s apex.

- If Jelle’s analysis proves correct, a breakout from the falling wedge pattern could have substantial implications for the broader cryptocurrency market.

- Therefore, another bearish rate hike will be a positive thing for cryptocurrencies.

In the image below you see how we have added some distance to the breakout level. However, a good rule of thumb often is to place the stop at a level that signals that the you were wrong, if it. Many times they’re https://g-markets.net/ combined with stop losses, which means that you have an exit mechanism that will get you out at a loss or a profit. Being so ubiquitous, false breakouts can be incredibly expensive if not dealt with correctly.

Is Bitcoin A Buy Or Sell? Ark Invest Shares Market Analysis

One of the biggest challenges breakout traders face, is that of false breakouts. As you might have guessed, a false breakout is when the market breaks out past a breakout level, but then reverses and goes in the opposite direction of the initial breakout. The original definition of the pattern dictates that the slope of both lines should preferably be sloping with the same angle. Still, if the support line, which is the lower one, falls with a less steep angle than the upper line, it shows us that the bearish forces are falling short on the low. If the coin manages to break past the $0.151 mark, the coin can begin to rally again providing respite to traders. Currently, Dogecoin has been moving between the price levels of $0.130 and $0.150 respectively.