Finding the target profit in sales dollars is similar to finding the break-even point in sales dollars except that “target profit” is no longer set to zero. Instead, target profit is set to the profit the company would like to achieve. With an understanding of the contribution margin and contribution margin ratio, we can now calculate the break-even point in sales dollars. We use the term “fixed cost” because it describes a cost that is fixed (does not change) in total with changes in volume of activity. You can also compute the new breakeven point that you’d need to meet if you decided to increase your fixed costs (for example, if you undertook a major expansion project or bought some new office equipment).

- When you know the contribution margin, you can make better decisions about whether to add or subtract a product line, about how to price your product or service, and about how to structure any sales commissions or bonuses.

- This conveys to business decision-makers the effects of changes in selling price, costs, and volume on profits (in the short term).

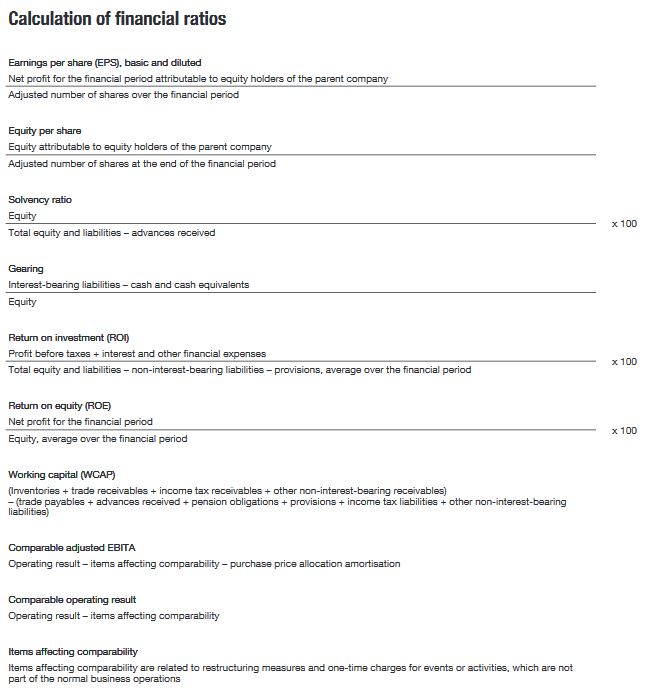

- These components involve various calculations and ratios, which will be broken down in more detail in this guide.

- We calculate it by subtracting variable costs per unit (V) from the selling price per unit (S).

- However, high operating leverage companies that encounter declining sales tend to feel the negative impact more than companies with low operating leverage.

If we have the contribution margin ratio for each department, we will need it for the company as a whole. Instead, profit is set to the target profit the company would like to achieve. Joe’s Carpentry Shop can see that a 10,000 unit increase in sales over break-even to 80,000 bird calls will produce a $4,000 profit, and a 30,000 unit increase to 100,000 bird calls will produce a $12,000 profit. Lillian’s Bakery can see that a 10,000 loaf increase in sales over the breakeven point to 80,000 loaves will produce a $7,000 profit, and a 30,000 loaf increase to 100,000 will produce a $21,000 profit. On the other hand, a decline in sales of 10,000 loaves from breakeven to 60,000 loaves will produce a loss of $7,000, and a 30,000 decrease from the 70,000 breakeven point produces a $21,000 loss.

Contribution Margin and CM Ratio

Cost-Volume-Profit Analysis (CVP analysis), also commonly referred to as Break-Even Analysis, is a way for companies to determine how changes in costs (both variable and fixed) and sales volume affect a company’s profit. With this information, companies can better understand overall performance by looking at how many units must be sold to break even or to reach a certain profit threshold or the margin of safety. A critical part of CVP analysis is the point where total revenues equal total costs (both fixed and variable costs). At this break-even point, a company will experience no income or loss. This break-even point can be an initial examination that precedes a more detailed CVP analysis.

If a company sells products or services easily measured in units (e.g., cars, computers, or mountain bikes), then the formula for break-even point in units is used. Increased volume can result in price weakness or higher-than-expected costs as you exceed your optimum levels of production. For most small businesses, limiting downside risk is more important than increasing potential profits, so it’s wise to keep your fixed costs low wherever possible. CM ratios and variable expense ratios are numbers that companies generally want to see to get an idea of how significant variable costs are. These are simplifying, largely linearizing assumptions, which are often implicitly assumed in elementary discussions of costs and profits. In more advanced treatments and practice, costs and revenue are nonlinear, and the analysis is more complicated, but the intuition afforded by linear CVP remains basic and useful.

The real-world business dangers of CVP analysis

For instance, the CVP can show an executive that in an economic downturn the company is at risk of losing money on sales of this product because they have a higher level of risk due to their lower margin of safety. The variable cost is the cost to make the sandwich (this would be the bread, mustard, and pickles). This cost is known as “variable because it “varies” with the number of sandwiches you make.

Masonite International Corporation Reports Solid Second Quarter … – Business Wire

Masonite International Corporation Reports Solid Second Quarter ….

Posted: Tue, 08 Aug 2023 20:30:00 GMT [source]

The

intersection of the revenue line and the total cost line indicates the

breakeven volume, which in this example, occurs between 571 and 572 units. The amount of profit or loss can be measured as

the vertical distance between the revenue line and the total cost line. Instead of using the contribution margin per unit in the denominator, multiple-product companies use a weighted average contribution margin per unit.

How is CVP Analysis used in management decisions?

These costs can be identified through an organization’s income statement or accounting records. There is often

a trade-off between fixed cost inputs and variable cost inputs. A merchandising company can pay its sales

force a flat salary (relatively higher fixed costs) or rely to some extent on

sales commissions (relatively higher variable costs). A restaurant can purchase

the equipment to launder table cloths and towels, or it can hire a laundry

service. Cost structure is the term used to describe the proportion of fixed and variable costs to total costs. We calculate it by subtracting variable costs per unit (V) from the selling price per unit (S).

For these types of companies, the break-even point is measured in sales dollars. Companies often want to know the sales required to break even, which is called the break-even point. If we compare Lillian’s Bakery in the first example and Joe’s Carpentry Shop in the second example, it is apparent that Lillian’s Bakery will benefit more from cost volume profit meaning increased sales than will Joe’s Shop. Wolters Kluwer is a global provider of professional information, software solutions, and services for clinicians, nurses, accountants, lawyers, and tax, finance, audit, risk, compliance, and regulatory sectors. KnowledgeBrief helps companies and individuals to get ahead and stay ahead in business.

The company was providing small pizzas that cost almost as much to make and just as much to deliver as larger pizzas. Because they were small, the company could not charge enough to cover its costs. At one point the company’s founder was so busy producing small pizzas that he did not have time to determine that the company was losing money on them. In addition, real-time CVP analysis has been essential during the period of COVID-19, particularly in industries such as hotels, just to keep the lights on according to experts in the industry. Use the target profit before taxes in the appropriate formula to calculate the target profit in units or sales dollars. Finding a target profit in units simply means that a company would like to know how many units of product must be sold to achieve a certain profit.

Cost-Volume-Profit Analysis Description *

In the next section, we’ll show that the concept of operating leverage explains why the mix of fixed and variable costs can have a large effect on your profit levels, as your sales volume increases and decreases. The contribution margin ratio with the unit variable cost increase is 40%. The additional $5 per unit in the variable cost lowers the contribution margin ratio 20%.

If yours is a service business, you may be able to divide your variable costs by the number of jobs performed (if the jobs are essentially similar) or by the hours spent on all jobs (if the jobs vary greatly in size). So there is a direct relationship between the cost of production, the volume of output, and profit earned. Again the profit of the firm is dependent on its total sales and total cost. It is because of the positive difference between gross revenue (sales), and the total cost is profit.

You can tell at a glance that the Beta Company’s contribution margin for the year was 34 percent. This means that, for every dollar of sales, after the costs that were directly related to the sales were subtracted, 34 cents remained to contribute toward paying for the direct costs and for profit. When you know the contribution margin, you can make better decisions about whether to add or subtract a product line, about how to price your product or service, and about how to structure any sales commissions or bonuses.

While these assumptions may be violated in practice, the results of CVP analysis are often “good enough” to be quite useful. Take your learning and productivity to the next level with our Premium Templates. Therefore, sales can drop by $240,000, or 20%, and the company is still not losing any money. There are several different components that together make up CVP analysis.

Break-Even Point in Units and the Weighted Average Contribution Margin per Unit

To simplify things, just decide which type of cost (fixed or variable) is the most important for the particular item, and then classify the whole item according to the more important characteristic. For example, in a telemarketing business, if your phone call volume charges are normally greater than your line access charges, you’d classify the entire bill as variable. The calculation of the break-even point is a part of cost-volume-profit analysis.

Operating leverage is an important concept because it affects how sensitive profits are to changes in sales volume. Operating leverage refers to the level of fixed costs within an organization. We can use the formula that follows to find the break-even point in sales dollars for organizations with multiple products or services. The formula used to solve for the break-even point in units for multiple-product companies is similar to the one used for a single-product company, with one change. First, we must expand the profit equation presented earlier to include multiple products.